- The Antifragilist

- Posts

- Market Crashes, Feds, Interest Rate, and Inflation - Part 2

Market Crashes, Feds, Interest Rate, and Inflation - Part 2

Federal Reserve

Hello, my fellow humans,

We are the Antifragilist, where we try to explain things to you like your favorite teacher in middle school. You know the kind that you had a crush on and anything they said sounded smart and funny.

So, I listed some of the major financial crashes of the last few centuries in my earlier post. I also mentioned that one crash, in particular, was pivotal for what we hear and read today on day to day basis.

The crash was the financial panic of 1907.

Let me paint you a picture.

It was a Saturday night in Oct 1907. John Pierpoint Morgan, aka, JP Morgan was sipping on his old-fashioned in his study and enjoying his weekend. His house butler informed him that he had a visitor from New York. The visitor was brought into his study where he mentioned timidly that he had bad news and apologized for ruining Morgan's weekend. Apparently, there was a panic on wall-street and he needed to get back to New York and save the economy from free fall.

So, I don't know if that's exactly what happened. I don't even know if JP Morgan drank. The picture below certainly suggests he did but who am I to make assumptions?

Anyways, JP Morgan did go back to New York and worked on saving the financial system. The failure of trust companies like Knickerbooks created a panic in the banking system that resulted in bank runs. Our boy, JP Morgan, summoned the heads of major banks and locked them in his private library until they had a plan and agreement to save the financial system. The result was a $25million pool of dinero that would be injected into banks and trust companies. it was assured that there would be money in the banks. New York City itself had to be bailed out. The stock exchanges were provided cash to carry out trading the securities.

The crisis was averted. But the wise ones understood what Alexander Hamilton was trying to do with BUS (Bank of United States). You couldn't rely on selected few individuals to step up and save the economy. The country needed a central bank that would facilitate the economy and be the lender of last resort. That would be the Federal Reserve System. The system would lend money to banks during crises, manage the money supply, supervise banks and act in the interest of the public (Not sure if everyone agrees with the last point though).

After a lot of brainstorming, debates, and secret meetings, finally, the federal reserve system was created on December 23, 1913, with the enactment of the Federal Reserve Act.

The Federal Reserve System operates outside of any political ideology or pressure (Trump tried). The system works within the objectives established by Congress. That's the reason, you see Jerome Powell, the current chairperson testify before congress regularly where he explains the various policies and plans for the future. The Federal Reserve System solidifies United States' economy and provides confidence to its various stakeholders (national and international) to invest and conduct business with us.

Boom and Busts are inevitable in a thriving economy. The Federal Reserve System has a lot of tools in its arsenal to tackle the busts and control the boom (what we are seeing right now). Wait for my next post on how they do it.

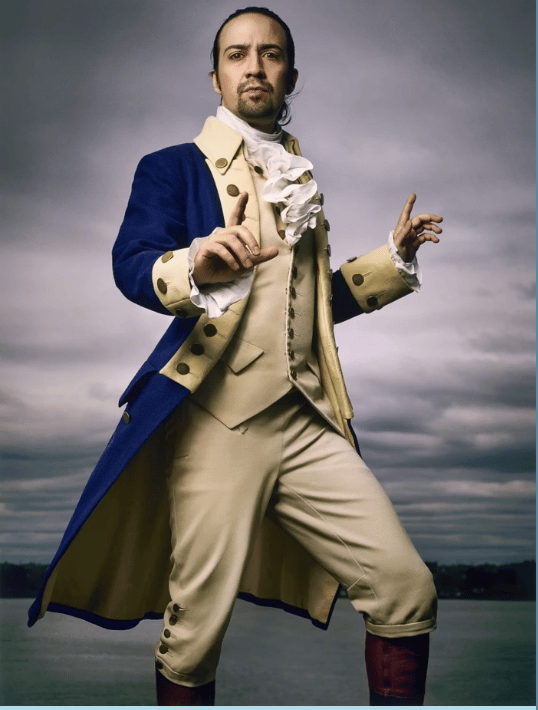

Until then, have fun and raise a glass to Alexander Hamilton this weekend.

That's Lin Manuel playing Alexander Hamilton in the Broadway "Hamilton". Shit was expensive but worth it (and I didn't even watch the original one).